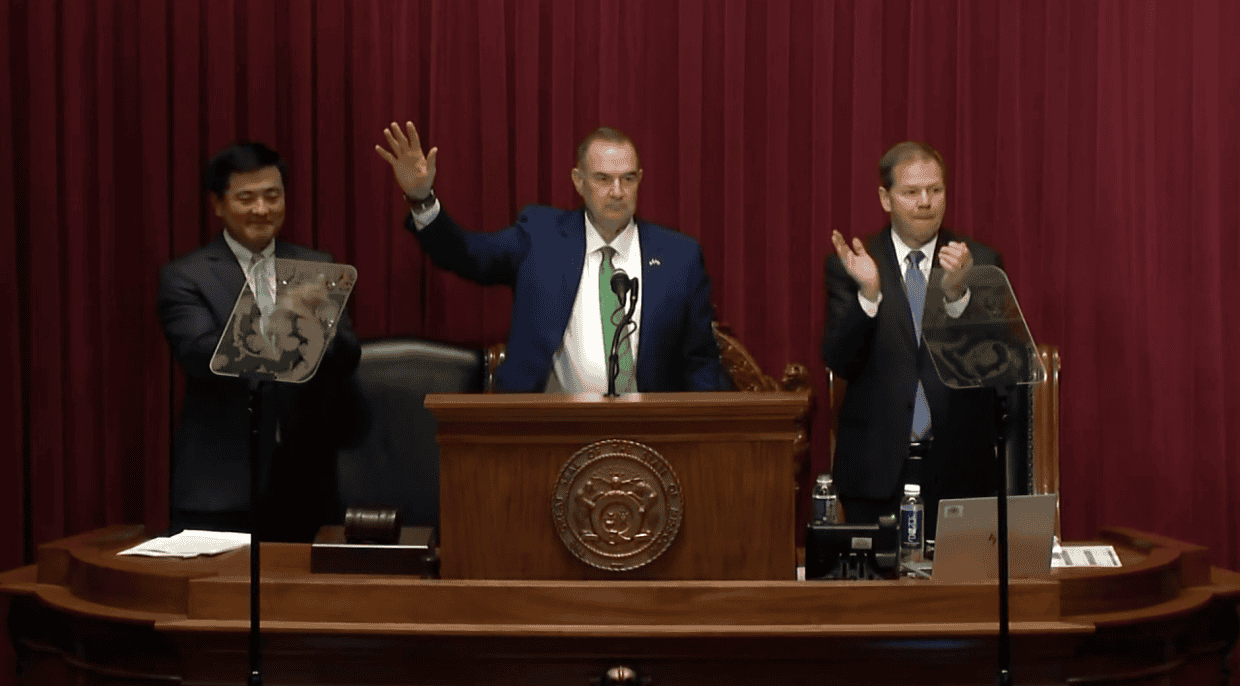

Nationwide Tax Competition Heats Up as Missouri Governor Calls for Zero Income Tax

In a move that is set to intensify the nationwide tax competition, Missouri Governor Mike Parson has called for the elimination of the state’s income tax. This proposal is part of a broader effort to make Missouri more attractive to businesses and individuals, and to stimulate economic growth.

The plan, which was announced earlier this week, would gradually reduce the state’s income tax rate to zero over a period of several years. According to Governor Parson, this move will not only benefit taxpayers but also make Missouri more competitive with other states that have already implemented similar tax policies.

Background

The idea of eliminating state income taxes is not new, and several states have already implemented such policies. For example, Texas, Florida, and Washington are just a few of the states that do not have a state income tax. These states have seen significant economic growth and have become popular destinations for businesses and individuals looking to relocate.

Other states, such as Kansas and Oklahoma, have also considered eliminating their state income taxes in recent years. However, these efforts have been met with resistance from lawmakers and taxpayers who are concerned about the potential impact on state revenue and public services.

Pros and Cons

Proponents of eliminating state income taxes argue that it will lead to increased economic growth, job creation, and competitiveness. They also argue that it will reduce the burden on taxpayers and make the state more attractive to businesses and individuals.

However, opponents argue that eliminating state income taxes will lead to a loss of revenue for the state, which could result in cuts to public services such as education, healthcare, and infrastructure. They also argue that it will benefit only the wealthy, as they are the ones who pay the most in income taxes.

| State | Income Tax Rate | GDP Growth Rate |

|---|---|---|

| Texas | 0% | 4.7% |

| Florida | 0% | 4.2% |

| Washington | 0% | 4.5% |

| Missouri | 5.2% | 3.5% |

Frequently Asked Questions

- Q: What is the current income tax rate in Missouri?

A: The current income tax rate in Missouri is 5.2%. - Q: How will the elimination of state income taxes affect Missouri’s economy?

A: The elimination of state income taxes is expected to lead to increased economic growth, job creation, and competitiveness. - Q: What states do not have a state income tax?

A: Texas, Florida, Washington, and several other states do not have a state income tax. - Q: How will the state make up for the lost revenue from eliminating income taxes?

A: The state is expected to make up for the lost revenue through a combination of increased sales taxes and other revenue-generating measures. - Q: Will the elimination of state income taxes benefit only the wealthy?

A: While it is true that the wealthy will benefit from the elimination of state income taxes, it is also expected to benefit middle-class taxpayers and small business owners. - Q: How will the elimination of state income taxes affect public services such as education and healthcare?

A: The elimination of state income taxes is not expected to have a significant impact on public services such as education and healthcare, as the state will make up for the lost revenue through other means. - Q: Can other states follow Missouri’s lead and eliminate their state income taxes?

A: Yes, other states can follow Missouri’s lead and eliminate their state income taxes, but it will depend on the specific economic and demographic conditions of each state. - Q: How will the elimination of state income taxes affect Missouri’s competitiveness with other states?

A: The elimination of state income taxes will make Missouri more competitive with other states, particularly those that have already eliminated their state income taxes. - Q: What are the potential risks associated with eliminating state income taxes?

A: The potential risks associated with eliminating state income taxes include a loss of revenue for the state, which could result in cuts to public services. - Q: How will the state ensure that the elimination of state income taxes is fair and equitable for all taxpayers?

A: The state will ensure that the elimination of state income taxes is fair and equitable for all taxpayers by implementing a combination of taxes and revenue-generating measures that will minimize the impact on low- and middle-income taxpayers.

The proposal to eliminate Missouri’s state income tax is a significant development that is set to have far-reaching implications for the state’s economy and taxpayers. While there are valid arguments on both sides of the debate, it is clear that the elimination of state income taxes has the potential to stimulate economic growth and make Missouri more competitive with other states.

As the debate continues, it is essential to consider the potential pros and cons of eliminating state income taxes and to ensure that the policy is implemented in a way that is fair and equitable for all taxpayers.

Image Credit: Americans for Tax Reform