Table of Contents

Toggle🔍 What is a SIP Calculator?

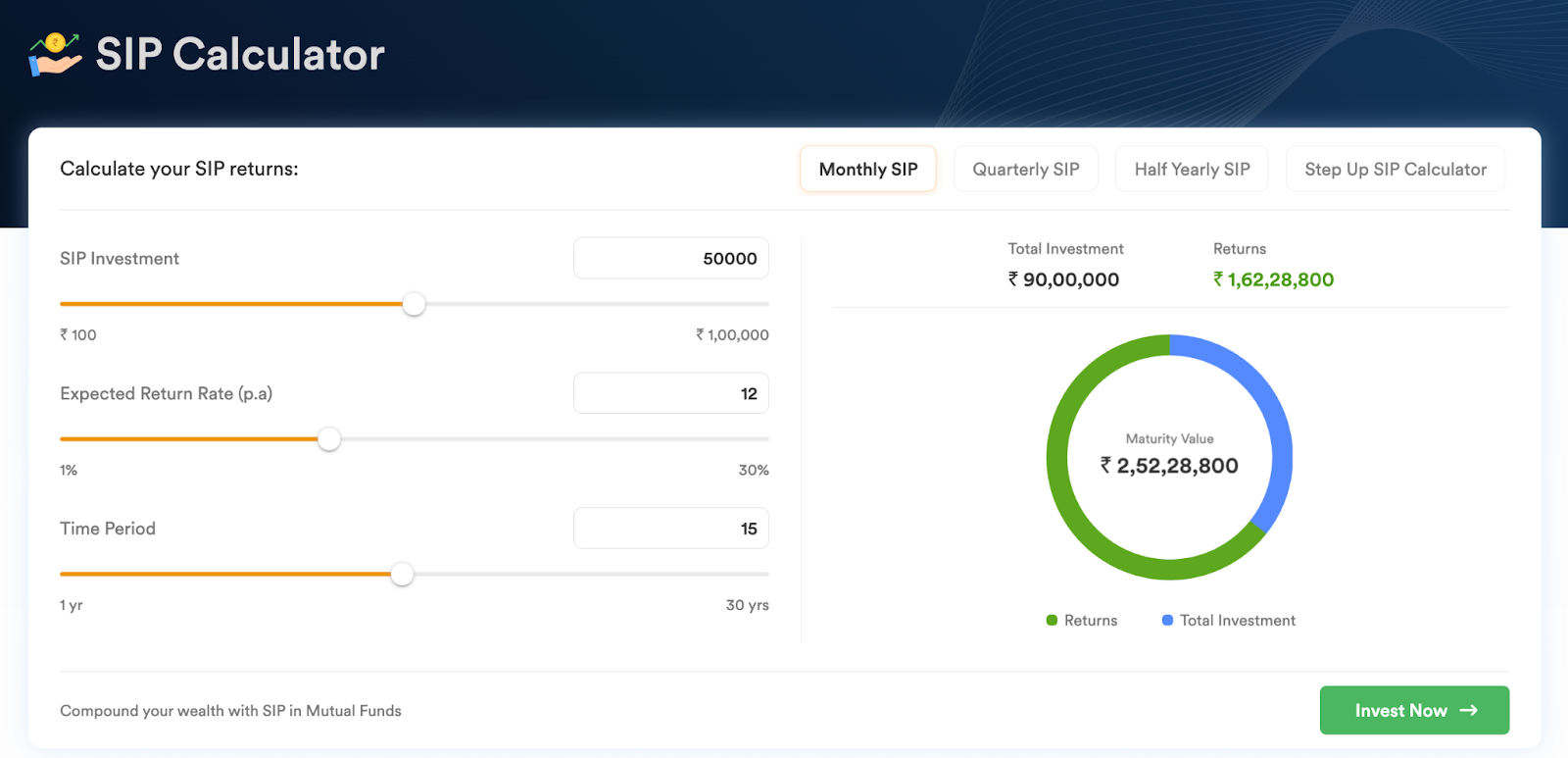

A Systematic Investment Plan (SIP) Calculator is an intuitive online tool designed to help investors estimate the potential returns on their mutual fund investments made through SIPs. By inputting your monthly investment amount, expected annual return rate, and investment tenure, you can visualize how your money grows over time.

CLICK HERE TO USE FOR FREE

⚙️ How Does the SIP Calculator Work?

The SIP Calculator employs the compound interest formula to project the future value of your investments:

FV = P × [ (1 + r)^n – 1 ] × (1 + r) / r

Where:

-

FV = Future Value of the investment

-

P = Monthly investment amount

-

r = Periodic interest rate (annual rate divided by 12)

-

n = Total number of payments (months)

This formula accounts for the power of compounding, illustrating how consistent investments can lead to significant wealth accumulation over time.

🧠 Why Use Our SIP Calculator?

-

Instant Projections: Get immediate insights into your investment growth.

-

Goal Planning: Align your SIPs with financial goals like buying a home, funding education, or retirement.

-

Informed Decisions: Compare different investment scenarios to choose the best plan.

-

User-Friendly Interface: Simple inputs and clear outputs make financial planning accessible to everyone.

📊 Real-Life Scenario: Transforming Dreams into Reality

Meet Priya, a 30-year-old marketing professional. She started investing ₹5,000 monthly in a SIP with an expected annual return of 12%. After 20 years, her investment grew to over ₹49 lakhs! This substantial corpus is now earmarked for her children’s higher education and a comfortable retirement. Priya’s disciplined approach and the SIP Calculator’s guidance turned her financial dreams into reality.

CLICK HERE TO USE FOR FREE

🧩 Key Features of Our SIP Calculator

-

Customizable Inputs: Adjust investment amounts, tenure, and expected returns.

-

Graphical Representations: Visualize your investment growth through intuitive charts.

-

Comparison Tools: Evaluate different SIP plans side by side.

-

Accessibility: Use the calculator on any device, anytime, anywhere.

🎯 Who Should Use This Tool?

-

Young Professionals: Kickstart your investment journey with informed decisions.

-

Parents: Plan for your children’s education and future needs.

-

Retirees: Manage and grow your retirement corpus effectively.

-

Financial Advisors: Provide clients with accurate projections and plans.

🧠 Pro Tips for Maximizing Returns

-

Start Early: The sooner you begin, the more you benefit from compounding.

-

Increase Investments Annually: Boost your SIP amount each year to accelerate growth.

-

Stay Consistent: Regular investments lead to substantial wealth over time.

-

Review Periodically: Reassess your SIPs to align with changing financial goals.

📢 Conclusion: Unlock Your Financial Potential Today!

Still contemplating your investment strategy? Don’t let indecision hinder your financial growth. Our SIP Calculator Online (2025 Edition) empowers you to take control of your financial future. Whether you’re saving for a dream home, your child’s education, or a comfortable retirement, this tool provides the clarity and confidence you need.

Act now! Harness the power of systematic investing and watch your wealth grow exponentially. Remember, the best time to start was yesterday; the next best time is now.

CLICK HERE TO USE FOR FREE

❓ Top 10 FAQs About SIP Calculator

-

What is a SIP Calculator?

-

A tool to estimate the future value of investments made through Systematic Investment Plans.

-

-

Is the SIP Calculator free to use?

-

Absolutely! It’s free and accessible to everyone.

-

-

Can I use it for different investment amounts?

-

Yes, input any monthly investment amount to see projections.

-

-

Does it account for varying interest rates?

-

You can adjust the expected annual return rate as needed.

-

-

Is it suitable for long-term planning?

-

Definitely! It’s ideal for planning investments over several years.

-

-

Can I compare different SIP plans?

-

Yes, the calculator allows for side-by-side comparisons.

-

-

Is my data saved on the platform?

-

No, we respect your privacy; no data is stored.

-

-

Can I access it on mobile devices?

-

Yes, it’s optimized for all devices.

-

-

Does it consider inflation?

-

The calculator provides nominal returns; consider inflation separately.

-

-

Is it suitable for beginners?

-

Absolutely! It’s designed for users at all levels of financial literacy.

-