Table of Contents

ToggleWhat is the Discovery Card?

The Discovery Card is one of the most popular credit cards, known for its attractive rewards, cash-back programs, and excellent customer service. Whether you are a frequent traveler, a business owner, or an everyday shopper, the Discovery Card offers a range of benefits to enhance your financial experience.

Why Choose Discovery Card?

The Discovery Card stands out among competitors due to its exclusive perks and low fees. Some of the main reasons why users prefer this card include:

- No Annual Fees: Unlike many premium credit cards, Discovery Card offers no annual fees, making it a cost-effective choice.

- Cashback Rewards: Earn cashback on everyday purchases, travel, dining, and entertainment.

- High Security: Advanced fraud protection and zero liability for unauthorized transactions.

- Flexible Payment Plans: Offers different payment options to suit various financial needs.

- Global Acceptance: Use it in millions of locations worldwide.

Key Features of Discovery Card

1. Reward Programs

The Discovery Card comes with multiple reward programs tailored for different spending categories. Cardholders can accumulate points or cashback depending on their spending habits.

2. Travel Benefits

- No foreign transaction fees

- Complimentary airport lounge access

- Travel insurance coverage

- Exclusive travel discounts

- Hotel and car rental discounts

- 24/7 travel assistance services

3. Security and Fraud Protection

- 24/7 fraud monitoring

- Instant card lock/unlock feature

- Secure online transactions

4. Cashback Options

- Up to 5% cashback on selected purchases

- Unlimited cashback with no expiration

5. Introductory Offers

- 0% APR for the first 12 months

- Sign-up bonus for new customers

How to Apply for a Discovery Card?

Applying for a Discovery Card is a simple process. Follow these steps:

- Visit the official Discovery Card website.

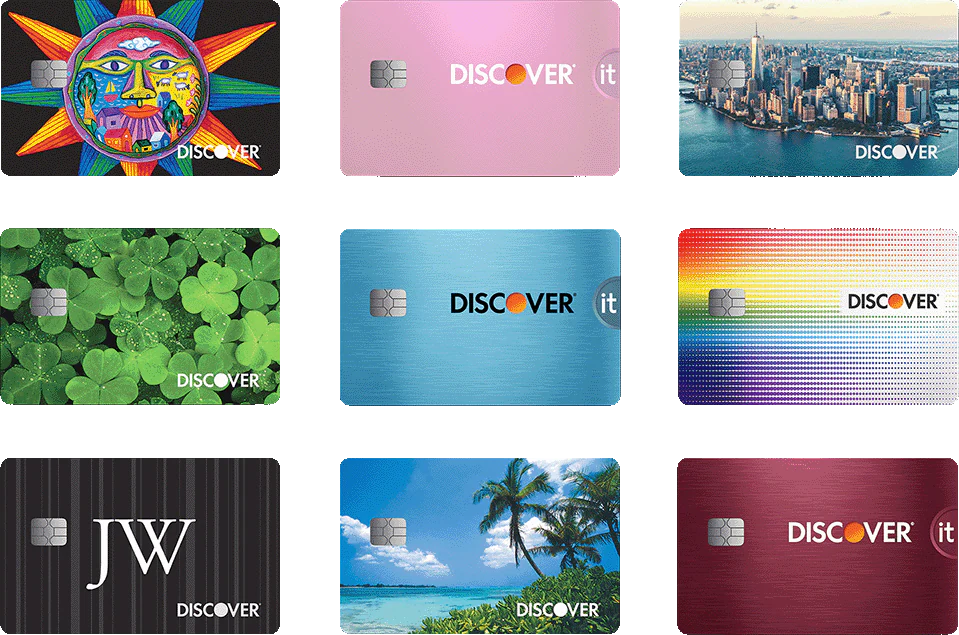

- Choose the preferred card option.

- Fill in personal and financial details.

- Submit required documents.

- Wait for approval (usually within 24-48 hours).

Eligibility Criteria

To qualify for a Discovery Card, you must meet the following criteria:

- Minimum age: 18 years

- Good credit score (typically 650+)

- Stable source of income

- Valid government-issued ID

Pros and Cons of Discovery Card

Pros:

✔ No annual fees ✔ High cashback and rewards ✔ Excellent customer service ✔ Flexible repayment options ✔ Strong security features ✔ Extensive travel benefits

Cons:

❌ Limited acceptance in some international locations ❌ Higher interest rates if not paid on time

Comparison with Other Credit Cards

| Feature | Discovery Card | Competitor A | Competitor B |

|---|---|---|---|

| Annual Fee | $0 | $99 | $75 |

| Cashback | Up to 5% | 2% | 3% |

| Foreign Fees | None | 3% | 2.5% |

| Sign-up Bonus | Yes | No | Yes |

| Travel Perks | Yes | Limited | Yes |

Best Ways to Maximize Your Discovery Card Benefits

- Use for Daily Purchases: Earn cashback on groceries, gas, and online shopping.

- Pay Full Balance Monthly: Avoid high-interest charges by clearing your dues every month.

- Leverage Travel Perks: Enjoy lounge access, travel insurance, flight discounts, and hotel savings.

- Book Travel Through Partners: Get exclusive discounts on flights and hotels by booking through Discovery Card’s travel partners.

- Refer a Friend: Many Discovery Card programs offer referral bonuses.

Discover customer service number

Discover customer service can be reached 24/7 by calling 1-800-DISCOVER (1-800-347-2683) to speak with a representative. For online banking technical support, customers can call 1-800-290-9885. Additional contact numbers are available for specific services, and customers can report lost or stolen cards at 1-800-642-4720.

- Discover’s primary customer service number is 1-800-DISCOVER (1-800-347-2683), available 24/7.

- Online Banking Technical Support can be reached at 1-800-290-9885.

- Discover Bank’s customer service can be contacted within the US at +1-800-347-2683.

- To file a complaint, customers can call 1-800-DISCOVER or (800) 347-2683 or use the secure message feature.

- An additional contact number provided is 1-877-383-4802 for directing calls to the appropriate person.

- For Discovery Customer Care, phone numbers 0124 434 9100 and 1-800-347-2683 are available.

- Lost or stolen credit cards can be reported immediately to 1-800-642-4720.

Frequently Asked Questions (FAQs)

1. Is the Discovery Card accepted worldwide?

Yes, the Discovery Card is accepted at millions of locations worldwide.

2. How long does it take to get approved?

Most applications are processed within 24-48 hours.

3. Does Discovery Card offer travel insurance?

Yes, travel insurance is included with selected Discovery Card variants.

4. What credit score is required for a Discovery Card?

A credit score of at least 650 is recommended for approval.

5. Is there a late payment fee?

Yes, late payments may incur fees and affect your credit score.

6. Can I upgrade my Discovery Card?

Yes, you can upgrade based on your spending habits and creditworthiness.

7. How do I check my reward points?

You can check your points through the Discovery Card mobile app or website.

8. What is the maximum cashback limit?

The cashback limit varies depending on the specific card type.

9. Are there any hidden charges?

No, Discovery Card maintains a transparent fee structure.

10. How do I contact Discovery Card customer service?

You can reach customer support via their official website, mobile app, or hotline number.

Conclusion

The Discovery Card is an excellent financial tool offering a variety of benefits, including high cashback rewards, no annual fees, and exceptional security features. Its extensive travel benefits make it a perfect choice for frequent travelers looking for savings on flights, hotels, and travel insurance. Whether you are looking for travel perks, flexible payments, or fraud protection, this card is a solid choice. Apply today to start enjoying its benefits!