Table of Contents

ToggleCar Insurance Quotes Online

Car insurance is one of those things every American driver needs — yet most of us dread shopping for it. Between confusing coverage options and ever-rising premiums, finding the cheapest car insurance can feel overwhelming.

But here’s the good news: thanks to online insurance comparison tools, drivers in 2025 have more control than ever. With just a few clicks, you can compare multiple insurers, get customized quotes, and save hundreds of dollars per year.

In this guide, we’ll break down the cheapest car insurance providers in the USA for 2025, how to compare quotes effectively, and insider tips to lower your premium without sacrificing coverage.

🚘 Why Car Insurance Costs Keep Rising in 2025

-

Inflation pushing up repair costs

-

More advanced (and expensive) vehicle technology

-

Increase in distracted driving accidents

-

Rising medical costs after accidents

-

Higher claims due to severe weather events

This makes shopping around online more important than ever.

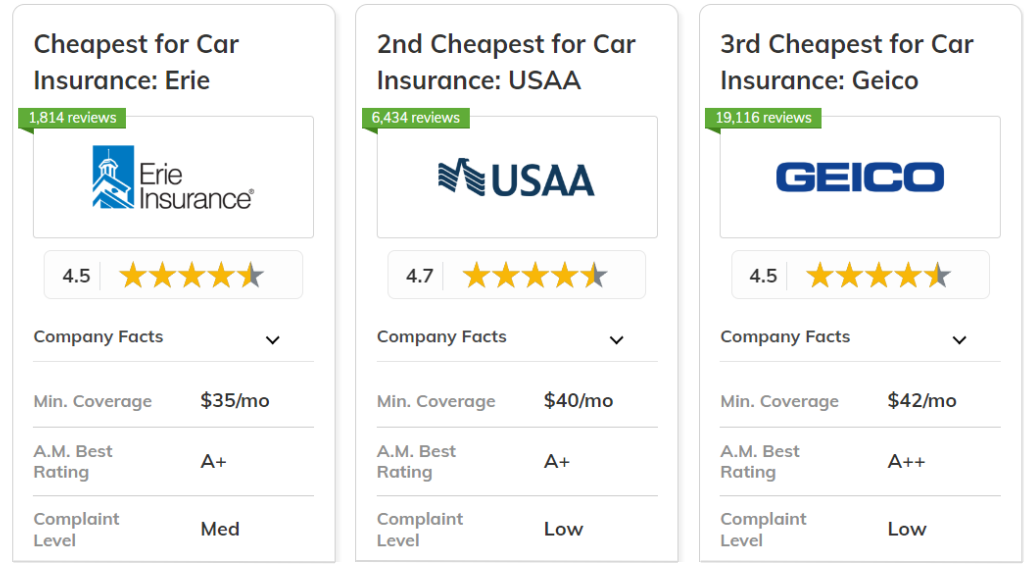

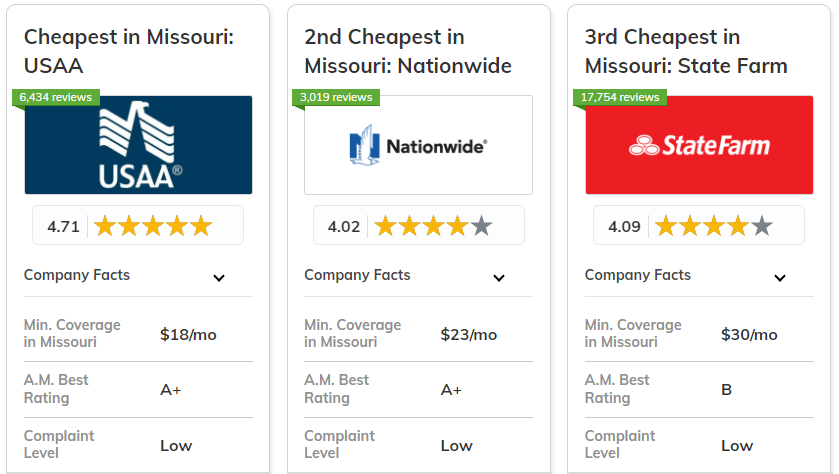

Cheapest Car Insurance Providers in the USA (2025)

| Insurance Company | Average Monthly Premium (USD) | Best For |

|---|---|---|

| GEICO | $90 – $110 | Overall affordability & discounts |

| State Farm | $95 – $120 | Nationwide availability |

| Progressive | $100 – $135 | Drivers with DUIs / high-risk drivers |

| USAA | $80 – $105 (members only) | Military members & families |

| Nationwide | $105 – $140 | Bundled policies |

| Liberty Mutual | $110 – $145 | Customizable coverage options |

🔍 How to Compare Car Insurance Quotes Online

-

Gather Information Beforehand

-

Driver’s license

-

Vehicle VIN number

-

Current insurance details

-

Driving history (accidents, tickets)

-

-

Use Trusted Platforms

-

Compare sites: The Zebra, NerdWallet, Policygenius

-

Direct insurer websites: GEICO, Progressive, State Farm

-

-

Check Coverage Options

-

Liability coverage (mandatory)

-

Collision coverage (repairs after accidents)

-

Comprehensive coverage (theft, natural disasters)

-

Uninsured motorist coverage

-

-

Look for Discounts

-

Safe driver discounts

-

Multi-policy bundles

-

Good student discounts

-

Military or veteran discounts

-

-

Adjust Deductibles

-

Higher deductible = lower premium, but more out-of-pocket in accidents.

-

✅ Pros & ❌ Cons of Buying Car Insurance Online

Pros

-

Quick, hassle-free quotes

-

Easy to compare multiple companies

-

Transparent pricing with discounts

-

Can switch insurers instantly

Cons

-

Too many options → decision fatigue

-

Some quotes may not reflect final underwriting price

-

Limited personalized guidance compared to an agent

📈 Expert Tips to Lower Your Car Insurance in 2025

-

Maintain a clean driving record (accidents/tickets = higher rates)

-

Bundle car + home/renter’s insurance

-

Install anti-theft devices or telematics trackers

-

Opt for usage-based insurance (pay-per-mile for low-mileage drivers)

-

Improve credit score (yes, insurers check it in most states)

🕒 How Often Should You Compare Quotes?

Experts recommend shopping for new quotes every 6–12 months. Why? Insurance companies change their pricing models frequently, meaning you could save money simply by switching providers at renewal.

Different Types of Car Insurance Coverage in the USA

When requesting quotes, you’ll often see multiple coverage options. Understanding them helps you choose wisely:

-

Liability Insurance – Covers bodily injury and property damage to others when you’re at fault. Required in almost all states.

-

Collision Coverage – Pays for damages to your own car after an accident, regardless of fault.

-

Comprehensive Coverage – Protects against theft, fire, floods, vandalism, or natural disasters.

-

Personal Injury Protection (PIP) – Required in some states; covers medical expenses for you and passengers.

-

Uninsured/Underinsured Motorist Coverage – Helps if you’re hit by someone without enough insurance.

-

Gap Insurance – Covers the difference between what you owe on your car loan and its current market value if totaled.

✅ Factors That Affect Car Insurance Quotes

Insurance companies calculate premiums based on multiple risk factors, including:

-

Age & Driving Experience – Young drivers often pay the highest premiums.

-

Location – Urban areas with high accident/theft rates cost more than rural towns.

-

Driving Record – Accidents, tickets, or DUIs can spike rates.

-

Type of Car – Luxury and sports cars usually cost more to insure than sedans.

-

Credit Score – In many states, insurers check your credit to determine risk.

-

Annual Mileage – Lower mileage can reduce your premium.

✅ Average Car Insurance Costs in the USA (2025 Estimates)

📊 According to recent data:

-

Minimum coverage: $65–$90/month

-

Full coverage: $150–$220/month

-

High-risk drivers (DUIs, accidents): $300+/month

✅ Tips to Get the Cheapest Car Insurance Quotes

-

Bundle Policies – Combine car and home insurance for discounts.

-

Increase Deductible – Higher deductibles lower monthly premiums.

-

Shop Around – Compare at least 3–5 insurers before choosing.

-

Use Telematics Programs – “Pay-per-mile” or “safe driver” programs can reduce costs.

-

Ask for Discounts – Good student, military, low-mileage, and multi-car discounts are widely available.

✅ Best Online Platforms to Compare Car Insurance Quotes

-

Progressive – Known for competitive rates and strong online tools.

-

Geico – Popular for low rates and discounts.

-

State Farm – Strong local agent network + mobile app.

-

Insurify & The Zebra – Aggregators that let you compare multiple quotes instantly.

-

Allstate – Good for high-risk drivers and accident forgiveness.

✅ Real-Life Example

Sarah, a 27-year-old in Texas, received a $220/month quote for full coverage from her bank’s recommended insurer. After comparing quotes on The Zebra, she found a Geico plan for $148/month, saving $864 per year.

🙋♂️ 10 Frequently Asked Questions (FAQs)

Q1. What is the cheapest car insurance company in the USA?

A: USAA (for military families) and GEICO are often the cheapest nationwide.

Q2. Is online car insurance cheaper than buying through an agent?

A: Usually yes, because online quotes cut out middleman fees.

Q3. How much is the average car insurance premium in 2025?

A: Around $130/month for full coverage; liability-only can be as low as $50.

Q4. Can I switch car insurance anytime?

A: Yes, but check cancellation fees on your current policy.

Q5. Do online quotes affect my credit score?

A: No, most insurers do a “soft check” that doesn’t impact credit.

Q6. Which state has the highest car insurance rates?

A: Michigan and New York tend to be the most expensive.

Q7. Which state has the lowest rates?

A: States like Maine and Ohio often have cheaper premiums.

Q8. Is usage-based (telematics) insurance worth it?

A: Yes, for safe drivers and those who drive less than 7,500 miles/year.

Q9. Do I need full coverage on an old car?

A: Not always — liability-only may be enough if the car’s value is low.

Q10. Can I get instant proof of insurance online?

A: Yes, most insurers send digital ID cards immediately after purchase.

Conclusion

Car insurance is a must-have, but overpaying for it is not. By using online comparison tools in 2025, American drivers can save hundreds while still getting the coverage they need. Whether you’re a student in California, a military veteran in Texas, or a family driver in Florida, the cheapest car insurance is only a few clicks away.

Remember: insurance isn’t just about cost — it’s about protection, peace of mind, and financial security. Shop smart, compare quotes regularly, and drive into the future with confidence knowing you’ve secured the best deal.